Best American Airlines Credit Cards

categories: Uncategorized

Everyone who can manage their credit card bills properly (paying them off completely every month) and likes to travel should have credit cards with travel benefits. If you are someone who only pays the minimum payment on your credit cards, stop reading this article, cut up your credit cards, and go watch cat videos. This article is not for you.

The plan for travel credit cards is a simple one. You make your normal purchases but in the process, you earn free trips.

Which credit card makes the most sense for you depends on where and how you travel. Where I live tend to fly American, United, or one of the smaller carriers so having a Delta credit card, for instance, would not make as much sense for me.

An American Airlines credit card might make sense for you if you live near one of the American Airline hub cities:

- Charlotte

- Chicago (O’Hare)

- Dallas/Fort Worth

- Los Angeles

- Miami

- New York – (JFK & LaGuardia)

- Philadelphia

- Phoenix

- Washington D.C. (National)

How Many Miles Will I Need

American has a Flight Awards Chart that will tell you how many miles you will need for a ticket. This will depend both on where you fly and when you fly. For example, a typical ticket for a domestic flight in the lower 48 states is 20,000 miles and a flight to Europe is 47,500 miles. If you fly off-peak on certain routes you can get a MileSAAver award which might drop that to 12,500 miles and 22,500 miles respectively.

As you would expect, tickets in Premium Economy and Business Class will cost more miles. For a flight to Europe, for instance, the flight that would take 47,500 in coach will cost 75,000 in Premium Economy and 110,000 in Business/First Class.

Bonus Miles for Signing Up

When you sign up for a card you will get a specified number of bonus miles if you use the card to spend a specific dollar amount within something like 3 months. I know that sounds vague but these deals change all the time. Click on the Apply button below to see what offers are being given currently. A good bonus is something like 50,000 miles and rarely I have seen them go as high as 100,000 miles. A no-fee card will also tend to have a smaller bonus.

Basic Cards vs Premium Cards

Most major airlines and hotel chains have a credit card. These cards tend to come in several different versions. The American Airlines cards are through Citibank and they start with a simple card with no annual fee and then get more expensive but add some pretty cool perks as you get into cards that work better for frequent travelers.

AAdvantage MileUp? Mastercard®

- Annual Fee $0

- Earn 2 miles for every $ spent on American Airline purchases or at grocery stores

- Earn 1 mile for every $ spent on other purchases

- Save 25% on in-flight food and drink purchases on American Airlines

- Fee for Foreign Purchases – 3%

Who is this card for?

This is a basic card that is about the same as you would have for most airlines. This is a fine card to get for infrequent travelers. It costs nothing and might earn you a free trip. With the foreign transaction fee (unlike the other 3 cards) it is not the best card for international travel.

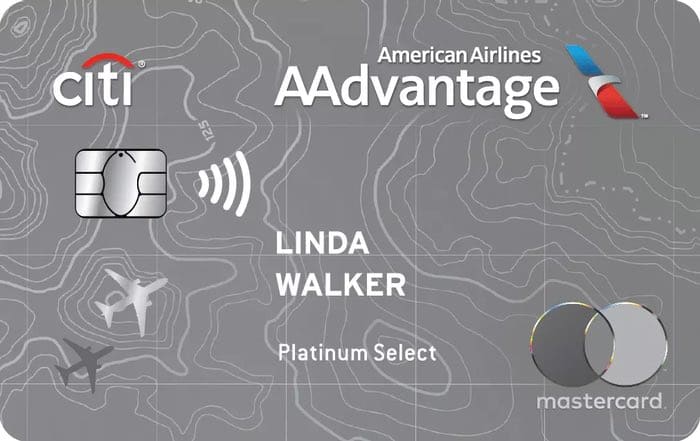

Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®

A step up from the MileUp card is the Platinum Select World Elite. This card accrues miles about the same but starts to introduce some interesting perks. If you spend more than $20K a year on credit card purchases then the free flight discount alone can pay for the annual fee. It is interesting that the MileUp will double my miles at the grocery store, but this one will double miles at restaurants. I think we spend more money on groceries but that is not true for many people.

- Annual Fee $99 (as of this writing waved for the first year)

- Earn 2 miles for every $ spent on American Airline purchases

- Earn 2 miles for every $ spent at restaurants

- Earn 2 miles for every $ spent at gas stations

- Earn 1 mile for every $ spent on other purchases

Travel Benefits

- Preferred Boarding on American flights

- 1st check bag free on domestic flights for you and up to 4 travel companions

- Earn a $125 flight discount after spending $20k in a card year upon renewal of the card

- Save 25% on in-flight food and drink purchases on American Airlines

Other Benefits

- No foreign transaction fees

Who is this card for?

If you spend more than $20K a year through your credit card then this card is a better one to get than the MileUp card. The free checked bag and the priority boarding are also a nice upgrade with this card.

Citi® / AAdvantage® Executive World Elite™ Mastercard®

A step up from the MileUp card is the Executive World Elite. This card accrues miles about the same but starts to introduce some interesting perks.

- Annual Fee $450

- Earn 2 miles for every $ spent on American Airline purchases

- Earn 2 miles for every $ spent at grocery stores

- Earn 1 mile for every $ spent on other purchases

Travel Benefits

- Admirals Club membership (a value of up to $650)

- Priority Boarding on American flights

- Global Entry or TSA Pre?® application fee credit

- Priority check-in for you and up to 8 travel companions

- Priority airport screening (where available) for you and up to 8 travel companions

- 1st check bag free on domestic flights for you and up to 8 travel companions

- Save 25% on in-flight food and drink purchases on American Airlines

Other Benefits

- Concierge service for help with travel plans

- No foreign transaction fees

Who is this card for?

This is not quite the card that George Clooney carried in the movie “Up in the Air” but think frequent traveler. Someone who is only trying to earn one free ticket a year for vacation won’t get as much value from this card as a frequent traveler. If you are in airports a lot the Admirals Club membership alone could probably justify the annual fee.

CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

This is a clever card for a business owner. Find yourself buying a lot of toner or office supplies for your company? This card can make you feel better about those purchases. You don’t have to have a brick and mortar store to be a business owner. Your business could be a side-business but it is more useful if you have regular expenditures that you can trade into points.

- Annual Fee $99 (as of this writing waved for the first year)

- Earn 2 miles for every $ spent on cable and satellite services

- Earn 2 miles for every $ spent on telecommunications (think cell phone bills)

- Earn 2 miles for every $ spent at gas stations

- Earn 2 miles for every $ spent on rental cars

- Earn 1 mile for every $ spent on other purchases

Travel Benefits

- Preferred Boarding on American flights

- 1st check bag free on domestic flights for you and up to 4 travel companions

- Save 25% on in-flight food and drink purchases on American Airlines

- Save 25% on in-flight wi-fi on American Airlines

- Earn a companion ticket for domestic travel after spending $30k in a card year upon renewal of the card

Other Benefits

- Concierge service for help with travel plans

- No foreign transaction fees

Who is this card for?

Obviously this card is meant for business owners. It does not have quite the cool add-ons that the Executive World Elite card has but then again, it has a much lower annual fee. It is interesting that you can earn mileage a bit faster on this card if you spend a lot on cell phone bills, internet bills, rental cars, and gas.

If you spend more than $30K a year in business expenses that you can put on the card then the companion ticket makes this card a no-brainer.

- Buy Travel Insurance

- Book Your Accommodation HERE

- Search for Great Tours HERE

- Get a Car Rental

+Chris Christensen | @chris2x | facebook

Leave a Reply

Tags: american airlines, article, credit card, travel 101

The Problem Using American Credit Cards Abroad

The Problem Using American Credit Cards Abroad Best Travel Credit Card

Best Travel Credit Card How to Choose the Best Travel Credit Card

How to Choose the Best Travel Credit Card Book Review – “Dear American Airlines” by Jonathan Mills

Book Review – “Dear American Airlines” by Jonathan Mills