Navigating the Labyrinth of Rental Car Insurance

When planning a trip that involves renting a car, one of the most critical questions that arise is whether or not to opt for rental car insurance. This article aims to provide a comprehensive guide on the topic, shedding light on the key considerations and options available to potential car renters.

Do You Need Insurance to Rent a Car?

While it’s not mandatory to have your own auto insurance policy to rent a car, rental agencies typically provide minimal coverage on their vehicles. Without adequate insurance, you could end up responsible for significant expenses if you’re involved in an accident with the rental car.

Understanding the Four Primary Types of Car Rental Insurance

Navigating the world of car rental insurance can be a daunting task, especially when you’re faced with multiple options at the rental counter. Understanding the four primary types of car rental insurance can help you make an informed decision and ensure you’re adequately covered during your rental period.

Collision Damage Waiver (CDW)

Often referred to as a Loss Damage Waiver (LDW), this isn’t exactly an insurance policy but rather a waiver that exempts you from monetary liability if the rental vehicle incurs damage or is stolen. It also encompasses “loss of use” fees – charges that rental firms impose for potential income lost during the repair of the damaged vehicle. However, this waiver may be void under specific situations, like if the damage occurs due to irresponsible driving or driving while under the influence of alcohol. Note that even if you have CDW coverage, it usually comes with a deductible (‘excess’) that can range from hundreds to thousands of dollars.

Supplemental Liability Insurance (SLI)

SLI provides coverage for damage you cause to other vehicles or property. It also covers medical expenses for others injured in an accident where you’re at fault. The coverage typically ranges from $1 million to $2 million.

If you have a personal auto insurance policy, it likely includes liability coverage. However, the limits may not be sufficient, especially in severe accidents involving multiple vehicles or injuries. SLI provides an additional layer of protection, ensuring you’re covered beyond your personal auto insurance limits.

Personal Accident Insurance (PAI)

PAI covers medical expenses for you and your passengers if you’re involved in an accident. This includes costs related to ambulance services, hospital care, and even death benefits.

If you have a robust health insurance policy or personal injury protection on your auto insurance, you may already be covered for such expenses. But if you’re traveling without adequate health insurance or in a region where your existing coverage doesn’t apply, opting for PAI can provide peace of mind.

Personal Effects Coverage (PEC)

PEC provides coverage for your belongings if they’re stolen from the rental car. This can be particularly useful if you’re traveling with valuable items like laptops, cameras, or other electronics.

However, if you have a homeowners or renters insurance policy, it may cover your personal belongings, even when you’re traveling. But remember, claims often involve a deductible and could potentially increase your future insurance premiums.

Does Your Car Insurance Cover Rental Cars?

In most cases, your auto insurance policy will provide equivalent coverage for a rental car, as long as you use it for personal purposes. For example, if you have comprehensive and collision insurance, your rental car will likely be covered if it’s damaged, stolen, or totaled, as long as the rental is of similar value to your own vehicle. However, your deductible will still apply if you file a claim with your insurer.

Rental Car Insurance vs. Your Own Auto Insurance

Here are the typical insurance options from rental car companies, along with how to determine if you already have coverage within your own auto insurance policy.

Crashes and Car Theft

At the rental car counter, a loss-damage waiver or LDW, also called a collision damage waiver or CDW, gets you off the hook for damage to the rental vehicle or theft of the car. It’s technically not insurance but rather a waiver that says the rental car company won’t come after you.

If you have collision and comprehensive coverage on your own policy, it generally will extend to a rental car, as long as you’re renting within the U.S. or Canada. However, you will still be responsible for your deductible, and filing a claim on your auto insurance policy could raise your premium.

Damage You Do to Others

Supplemental liability protection will pay for damage you do to others’ vehicles or property. Typical limits range from $300,000 to $1 million. If you don’t have auto insurance (for example, if you don’t own a car), or if you’re traveling in a country where your own policy doesn’t offer coverage, you should buy this.

Injuries to You

Personal accident insurance covers medical costs for you and your passengers if you’re involved in an accident. This includes ambulance, medical care, and death benefits.

Your Stolen Stuff

Personal effects coverage pays for your belongings if they’re stolen from the rental car, up to a set dollar amount.

Using Your Credit Card for Rental Car Coverage

Many credit cards, especially travel credit cards, offer rental car insurance coverage as a benefit to cardholders free of charge. But whether it’s enough to waive coverage at the rental desk will depend on several factors. One important thing to note about credit card rental car insurance benefits is that they’re usually secondary, meaning they will kick in after your personal insurance policy or the insurance coverage offered by the rental car company are utilized.

Safeguarding Your Journey with Car Rental Excess Insurance

Car rental excess insurance is a policy that covers the excess amount you would need to pay in the event of a claim. When you rent a car, the rental company’s insurance usually includes an excess, which is the amount you’re liable to pay towards repair or replacement costs if the vehicle is damaged or stolen. This excess can be quite high, sometimes reaching thousands of dollars.

Car rental excess insurance is designed to reimburse you for this excess charge, providing an additional layer of financial protection. It’s typically offered by third-party insurance providers and is separate from the insurance provided by the car rental company.

The Benefits of Car Rental Excess Insurance

The primary benefit of car rental excess insurance is financial protection. If you’re involved in an accident or the rental car is damaged or stolen, you could be liable for a significant excess charge. Car rental excess insurance covers this cost, ensuring you’re not out of pocket.

Another advantage is the potential for more comprehensive coverage. Some car rental excess insurance policies offer coverage for areas that the rental company’s insurance might not, such as damage to the windshield, tires, undercarriage, and roof.

Where to Purchase Car Rental Excess Insurance

Here are several sources where you can purchase car rental excess insurance.

Car Rental Companies

The most obvious place to purchase car rental excess insurance is directly from the car rental company. When you rent a vehicle, the company will typically offer you various insurance options, including excess insurance. However, insurance from rental companies can often be more expensive than other options, so it’s worth shopping around.

Car Rental Excess Insurance Price Comparison

As in the Amateur Traveler guide to European Car Rental, Rentals that boast “includes insurance” don’t always provide full coverage and often you’ll need to pay around 30% extra, or $15-30 extra per day. I’ve compared the cost of rental car excess insurance for a 7-day rental of a standard car class (July 1st – July 7th) in Barcelona Airport.

The averages presented below are based on Super Collision Damage Waiver costs offered by the rental companies.

| Rental Company | Mandatory Insurance in Australia – Collision Damage Waiver (CDW) + Theft Protection (TP) | Avg. Super Collision Damage Waiver Cost at Counter* | Avg. Insurance Deductible at Counter* |

| Avis | Included in the rental price | US$ 23.16 | US$ 2,875 |

| Budget | Included in the rental price | US$ 24.90 | US$ 3,265 |

| Dollar | Included in the rental price | € 19.16 | US$ 1,524 |

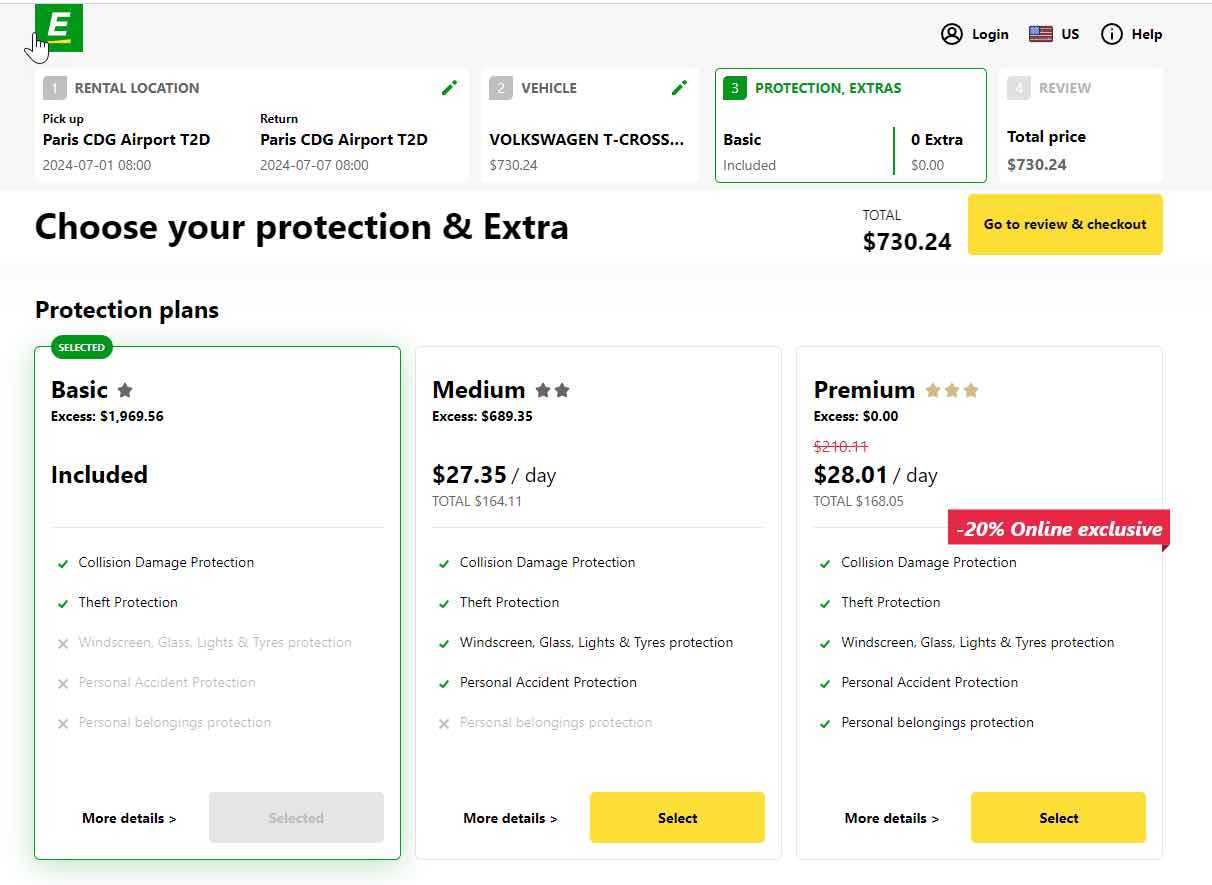

| Europcar | Included in the rental price | US$ 28.01 | US$ 1,969 |

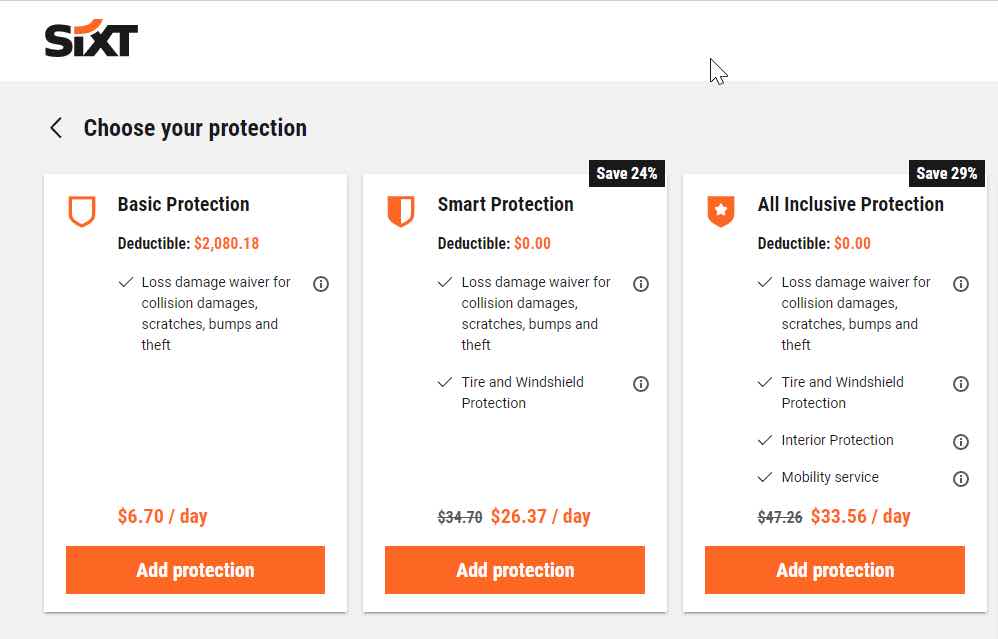

| Sixt | US$ 6.70 / day | US$ 33.56 | US$ 2,080 |

- Get a Car Rental

- Book Your Accommodation HERE

- Search for Great Tours HERE

- Buy Travel Insurance

Sixt car rental insurance options and pricing

Europcar car rental insurance options and pricing

Standalone Car Rental Insurance Providers

Several companies, like Allianz Global Assistance, CarInsuRent, and Sure, specialize in providing standalone car rental insurance. These policies often offer more comprehensive coverage than those provided by car rental companies and might be more affordable.

CarInsuRent car rental excess insurance starts from as low as $6.49 per day to $94.90 for an annual policy. Their policies cover the excess on damage and theft up to US$ 4,500 and provide full protection that Includes single vehicle damage, roof and undercarriage damage, auto glass and widescreen damage, towing expenses, misfuelling, loss of car key, and tire damage.

Credit Card Providers

Many credit card providers offer rental car insurance as a perk for their cardholders. This coverage often includes excess insurance, but it’s important to check the specifics of your card’s benefits. Note that to avail of this coverage, you typically need to pay for the rental using the card that provides the benefit.

Travel Insurance Providers

Many travel insurance policies include coverage for rental cars, which can include excess insurance. If you’re planning a trip and have already decided to purchase travel insurance, check if rental car coverage is included. If not, you might be able to add it for an additional fee.

The Bottom Line: Do You Need Rental Car Insurance?

You may not need to buy the rental car company’s insurance if you’re traveling within the U.S. or Canada and your own auto policy provides sufficient coverage, your credit card offers rental car insurance, or you’ve bought standalone coverage through a separate company.

However, you may want to buy the rental car company’s insurance if you’re worried about having to pay a deductible or a higher rate on your auto insurance if you damage a rental car, you don’t have your own car insurance or coverage through a credit card, or you’re traveling overseas where your personal auto policy won’t cover you.

There are multiple sources where you can purchase car rental excess insurance. It’s worth comparing the coverage options, costs, and terms and conditions from each source to find the best fit for your needs. Remember, the goal is to ensure you’re adequately covered while also getting the best value for your money.

In conclusion, whether or not to opt for rental car insurance depends on your personal circumstances, including your existing coverage and the specifics of your trip. It’s crucial to do your research, understand your options, and make an informed decision that best suits your needs and circumstances.

Leave a Reply

Tags: article, rental car, travel insurance

What is Travel Insurance? Do I Need Travel Insurance in 2024?

What is Travel Insurance? Do I Need Travel Insurance in 2024? Travel Insurance – The Reassurance You Can’t Do Without

Travel Insurance – The Reassurance You Can’t Do Without The Ultimate Guide to Rental Cars

The Ultimate Guide to Rental Cars How to Choose the Best Travel Credit Card

How to Choose the Best Travel Credit Card