I need to confess that for years I traveled without travel insurance. When one of the people on the 2015 Amateur Traveler trip to Morocco didn’t read the fine print that travel insurance was required… I was that guy. But I have reformed. I now have an annual plan that covers all my travels.

Table of contents: ()

The Advantages and Disadvantages of Travel Insurance

The disadvantages of travel insurance are easy. It costs money. If you could know ahead of time whether your trip would go well you wouldn’t need insurance. If you have enough savings to cover anything that might come up, then maybe you also can do without insurance. But… let’s talk about what might happen and what that could cost.

The advantages are also pretty easy. If something goes wrong travel insurance will help… provided you have the right kind of insurance.

Common Questions about Travel Insurance

After you finish this article I hope you will have answers to these questions:

- how travel insurance works

- why travel insurance is important

- what travel insurance covers

- what travel insurance do I need

As well as some more specific questions like:

- will travel insurance cover cancellation due to hurricane

- will travel insurance cover a missed flight

- will travel insurance cover my phone

- will travel insurance cover flight cancellation

The Kinds of Travel Insurance

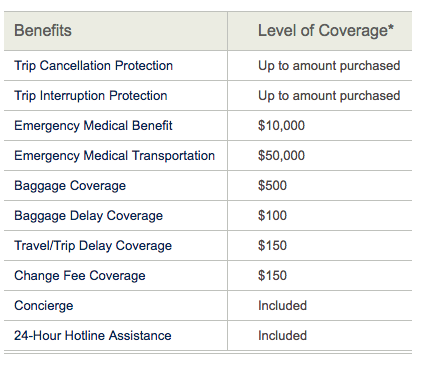

The term travel insurance is a bit vague. There are actually many different kinds of insurance. I have an annual policy with Allianz so let’s look at a typical policy from them as an example:

Travel Insurance and Pandemics like Covid-19

Travel insurance seems like it would be perfect to have in the year when we had a pandemic but the real truth is that it’s complicated. There were many cases where people canceled flights last year when the government had not closed flights and when the airlines were still operating the route. They were, in many cases, surprised that their travel insurance did not cover the cost of the trip. “I was reluctant to fly” is not a sufficient reason for most travel insurance protection.

In 2022, or any year with a pandemic, it is good to check the reasons you can cancel a trip on your policy more closely before you book. Hotels can often be canceled a few days ahead but check before you book. Many airlines have made their cancellation policies easier in 2020 and 2021 but don’t assume that. Look at the airline website for charges for changing your flight before you book.

Policies that allow you to cancel a trip for any reason are more expensive as they need to be since the insurance company is taking more risk. Check out Cancel for any reason insurance with Travel Guard.

- Buy Travel Insurance

- Search for Great Tours HERE

- Book Your Accommodation HERE

- Get a Car Rental

Trip Cancellation Protection / Trip Interruption Protection

Trip Cancellation and Trip Interruption are pretty similar. In general, they help pay for the cost of the trip if you either can’t go (for some covered reason) or have to cancel your trip partway through (again for some covered reason). So Let’s say you had booked a flight and a week’s long hotel stay and all of this was covered by the insurance that you bought. If you got sick and could not go, then you would be paid the price of the flight plus the cost of the hotel stay under this plan.

This is the kind of insurance that you are often offered when you book a flight on a major airline or when you book a cruise.

You can’t just cancel a trip for no reason. The typical kinds of reasons that are covered are:

- You or your travel companions get sick or injured, for example, your wife breaks her leg before or during your ski vacation

- A family member or business partner gets sick or injured, for example, your parent or child gets sick right before the big trip (even if they are not traveling with you)

- A hurricane or other natural disaster strikes your travel destination

- The company you book your travel with goes into bankruptcy or financial default (Like when Monarch Airlines or airberlin closed down in 2017)

- The destination you are traveling to is hit by a terrorist attack or some event that requires mandatory evacuation (In 2006 Anthony Bourdain and his TV crew traveled to Lebanon when war broke out with Israel, they were evacuated by U.S. marines)

- The person hosting you at the destination dies or is hospitalized

- Your home or your business is vandalized, burglarized, or damaged in some other way

- You are required to attend Jury duty, or make a court appearance, or are part of a military redeployment

- You can’t travel because you are required to work, or you lose your job or are transferred

- You are the victim of an assault before your trip

- You are the victim of a traffic accident before your trip

- Your passport is stolen before your trip

- You or your child are in school and for some reason, the school year gets extended

- You get divorced or separated (You don’t still have to go on that second honeymoon as you would have to in the movies)

Check your specific policy for the reasons that are covered.

Emergency Medical Benefit

If you get sick or injured on your travels this insurance will pick up some of the cost of medical or dental bills (possibly those that your own health insurance doesn’t cover, check the fine print). These expenses may be higher in some countries than in others. For instance, one day in a hospital in the USA will probably cost more than one day in Europe which will cost more than one day in a 3rd world country.

Note that typically this only covers you until you return home when your regular medical insurance would need to start picking up the bills. I have a friend who got a detached retina on a trip. He was being covered well while he was overseas but did not realize that would all end when he returned home.

Emergency Medical Transportation

I have a friend that took a fall and broke his back in the Amazon. While they could do some things for him, the real solution was to fly him home again in an air ambulance. Those bills add up really quickly, think 10s of thousands of dollars. This benefit will get you home or to the nearest appropriate medical facility.

Baggage Coverage

This benefit provides reimbursement if your luggage is lost, damaged or stolen while you are traveling. You may also have some coverage under the off-premises coverage in your homeowners or renters insurance. You might want to check what that will cover and what deductibles there will be. The airline should also provide compensation if your bag is lost. Consult the “contract of carriage” for the airline.

Baggage Delay Coverage

If you go to San Jose, California and they book your luggage to San Jose, Costa Rica (yes they have tried to do this to my luggage) then this coverage will reimburse you for some of the clothes, toiletries, etc you may have to purchase. It probably won’t cover your bag is delayed for less than a day. The airline may provide some help if your bag is seriously delayed. Consult the “contract of carriage” for the airline.

Travel / Trip Delay Coverage

This benefit helps with additional meals, hotel rooms, and lost prepaid expenses when your travel is delayed. In this sample plan, you would have to be delayed for more than 6 hours.

Change Fee Coverage

Change Fee Coverage

This benefit helps pay for the fee that you will incur if you try and change a typical airline ticket. A few airlines, like Southwest, have no change fee but for many, it can be as high as $200.

Concierge

This is not strictly travel insurance and it is more rare. Allianz provides help for their travelers to book restaurants or tee times or get theatre tickets. Look to see if your travel insurance comes with any extra benefits.

24-Hour Hotline Assistance

Again, this is not strictly travel insurance, but more how they will help you. Allianz says, “In the event of a covered travel or medical emergency, multilingual representatives offer round-the-clock assistance, whether you need emergency cash, flight information, legal assistance, a message sent home, or help to deal with a medical emergency.” Some travel insurance will just be who you need to contact later on.

Rental Car Insurance

Note that Rental Car Insurance, while also a type of travel insurance, is not typically covered by even a comprehensive travel insurance policy. You will need to purchase that separately or rely on your regular car insurance. Note that some credit cards like Visa say:

“The Auto Rental Collision Damage Waiver (“Auto Rental CDW”) benefit offers insurance coverage for automobile rentals made with your Visa card. The benefit provides reimbursement (subject to the terms and conditions) for damage due to collision or theft up to the actual cash value of most rental vehicles.”

What they don’t say is that being subject to terms and conditions means that they only pay for what your regular car insurance does not pay for, in my experience. That came as a bit of a surprise to me.

Conclusion

If you have problems on or before a trip and you need travel insurance, you will be glad you have it. Here are some vendors I trust. They are all Amateur Traveler affiliates.

+Chris Christensen | @chris2x | facebook

3 Responses to “What is Travel Insurance? Do I Need Travel Insurance in 2024?”

Leave a Reply

Tags: article, travel 101, travel insurance

Change Fee Coverage

Change Fee Coverage Understanding Car Insurance (SLI / CDW / PAI / PEC)

Understanding Car Insurance (SLI / CDW / PAI / PEC) Travel Insurance – The Reassurance You Can’t Do Without

Travel Insurance – The Reassurance You Can’t Do Without 8 Frequently Asked Questions about Travel Health in 2024

8 Frequently Asked Questions about Travel Health in 2024 Top Jobs for Digital Nomads in 2024

Top Jobs for Digital Nomads in 2024

allianz Travel Insurance

Says:January 18th, 2023 at 5:22 am

Impressive! Thanks for sharing this.

Teresa Bretl

Says:February 24th, 2023 at 3:55 pm

We are planning a one month trip to Europe and 2 weeks of the trip is a group tour of Italy. The other 2 weeks we travel on our own in various parts of Germany. Can we buy insurance for the entire trip?

Chris Christensen

Says:February 25th, 2023 at 9:20 am

Yes, you can even buy trip insurance for an entire year. It just depends on the policy.